illinois payroll withholding calculator

Illinois State Disbursement Unit. The wage base is.

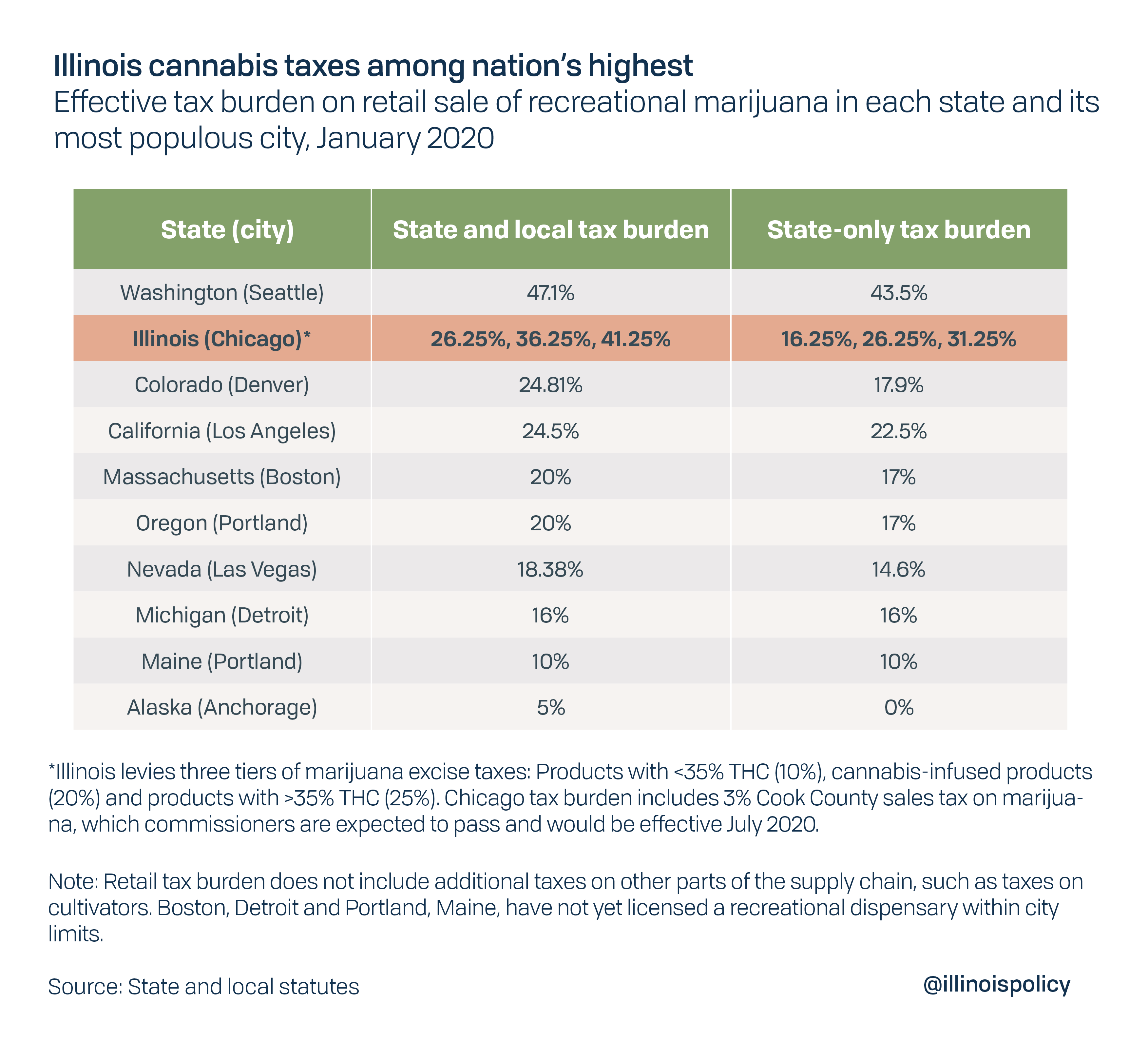

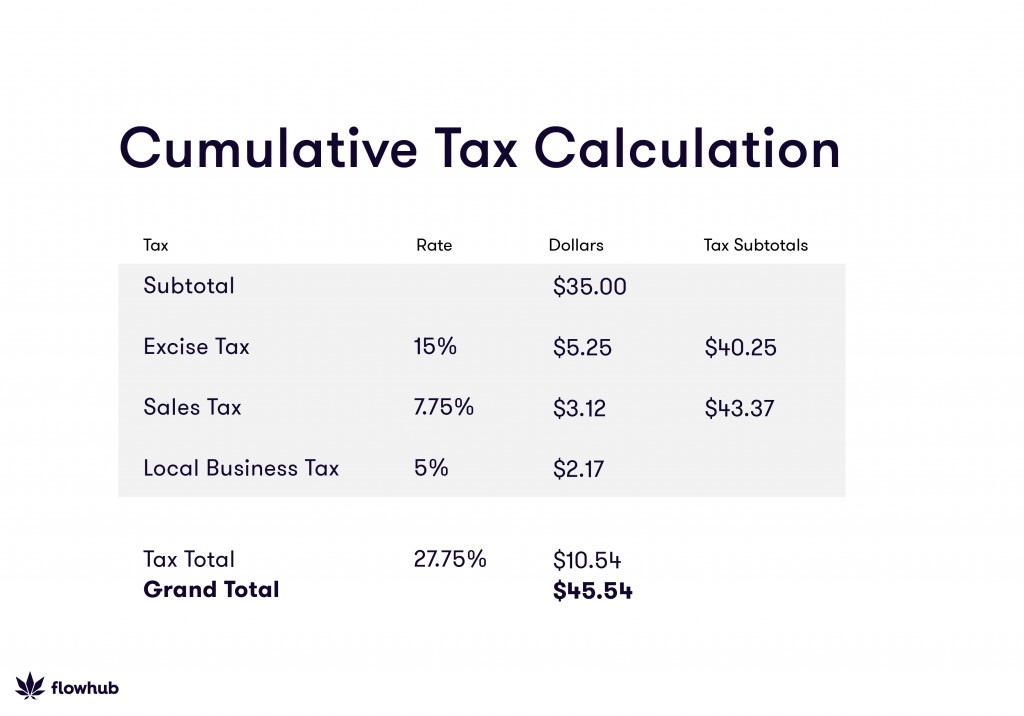

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

This is a projection based on information you provide.

. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator. Enter your new tax withholding. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Free Federal and Illinois Paycheck Withholding Calculator. Just enter the wages tax withholdings and other information required. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

2022 Federal Tax Withholding Calculator. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Free federal and illinois paycheck withholding calculator. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed.

This calculator is a tool to estimate how much federal income tax will be withheld. This is a projection based on information you provide. The results are broken up into three sections.

Below are your Illinois salary paycheck results. Carol Stream IL 60197-5400. Youre not the only business owner in Illinois poring over payroll taxes for your hourly employees.

Deducts the child support withholding from the employees wages. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Paycheck Results is your gross pay and specific.

Illinois child support payment information. 2022 Federal Tax Withholding Calculator. Illinois Hourly Paycheck Calculator.

Just enter the wages tax withholdings and other information required. The results are broken up into three sections. Or keep the same amount.

Illinois Hourly Payroll Calculator. To change your tax withholding amount. Use your estimate to change your tax withholding amount on Form W-4.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Youll use your employees IL-W-4 to calculate how much to. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. The waiver request must be completed and submitted back to the department. Remit Withholding for Child Support to.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Instead you fill out Steps 2 3 and 4. Below are your Illinois salary paycheck results.

If the income is paid biweekly multiply the minimum wage times 60 60 x 825 495. SERS Contact Information 2101 S. This is a projection based on information.

Illinois Hourly Paycheck Calculator Results.

State Income Tax Rates Highest Lowest 2021 Changes

How To Register File Taxes Online In Illinois

Paycheck Calculator Free Payroll Tax Calculator Online Payroll Software

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

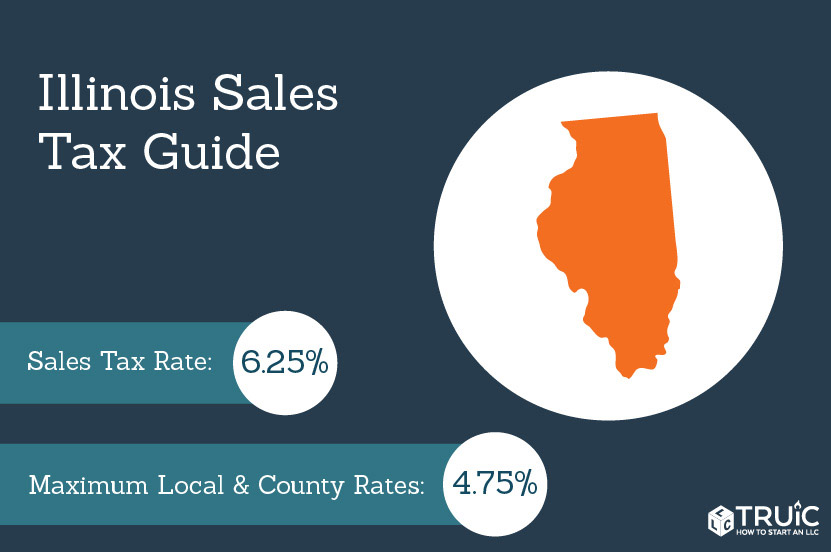

Illinois Sales Tax Small Business Guide Truic

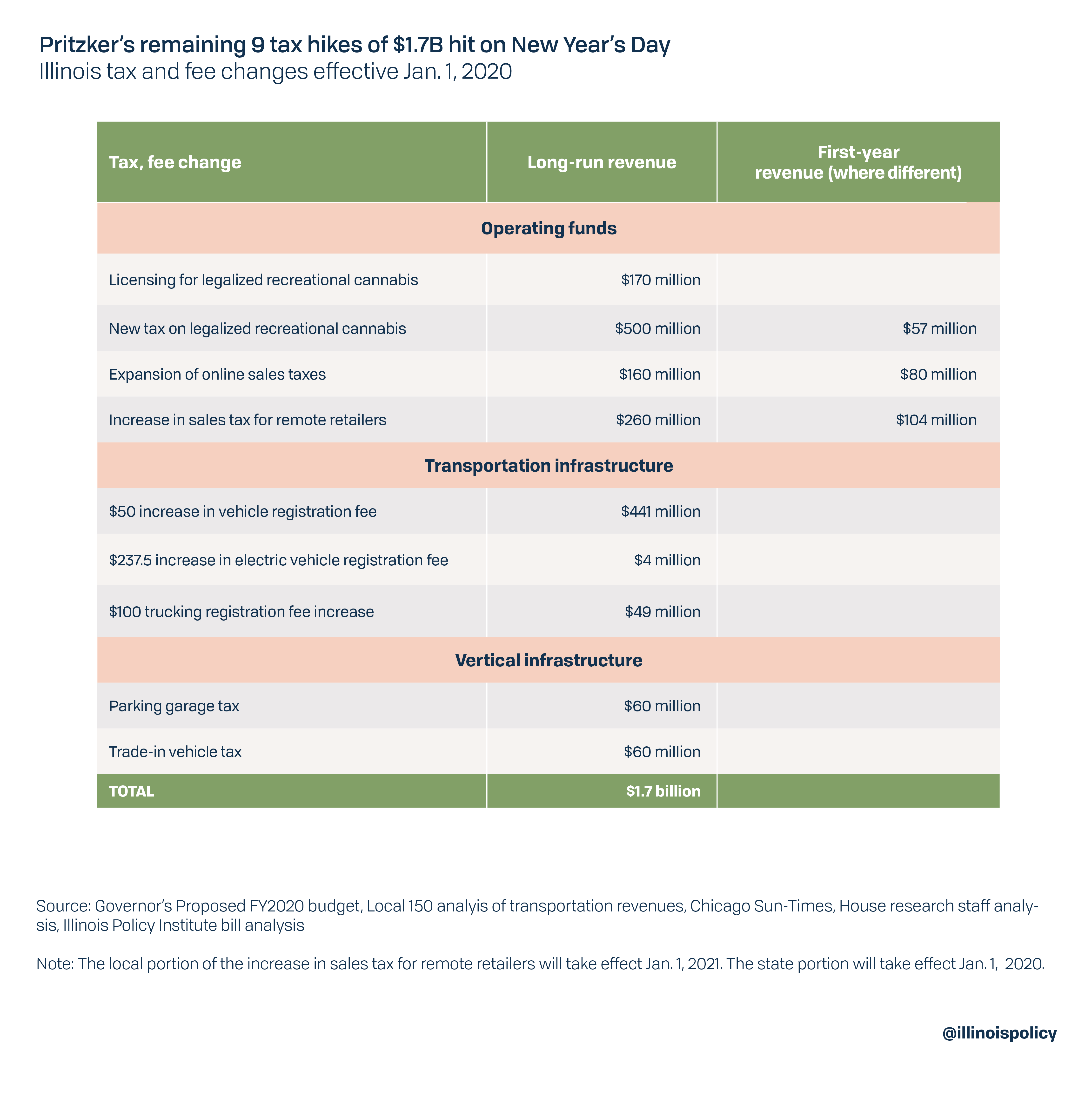

9 New Illinois Taxes Totaling 1 7b Take Effect Jan 1

Payroll Tax Calculator For Employers Gusto

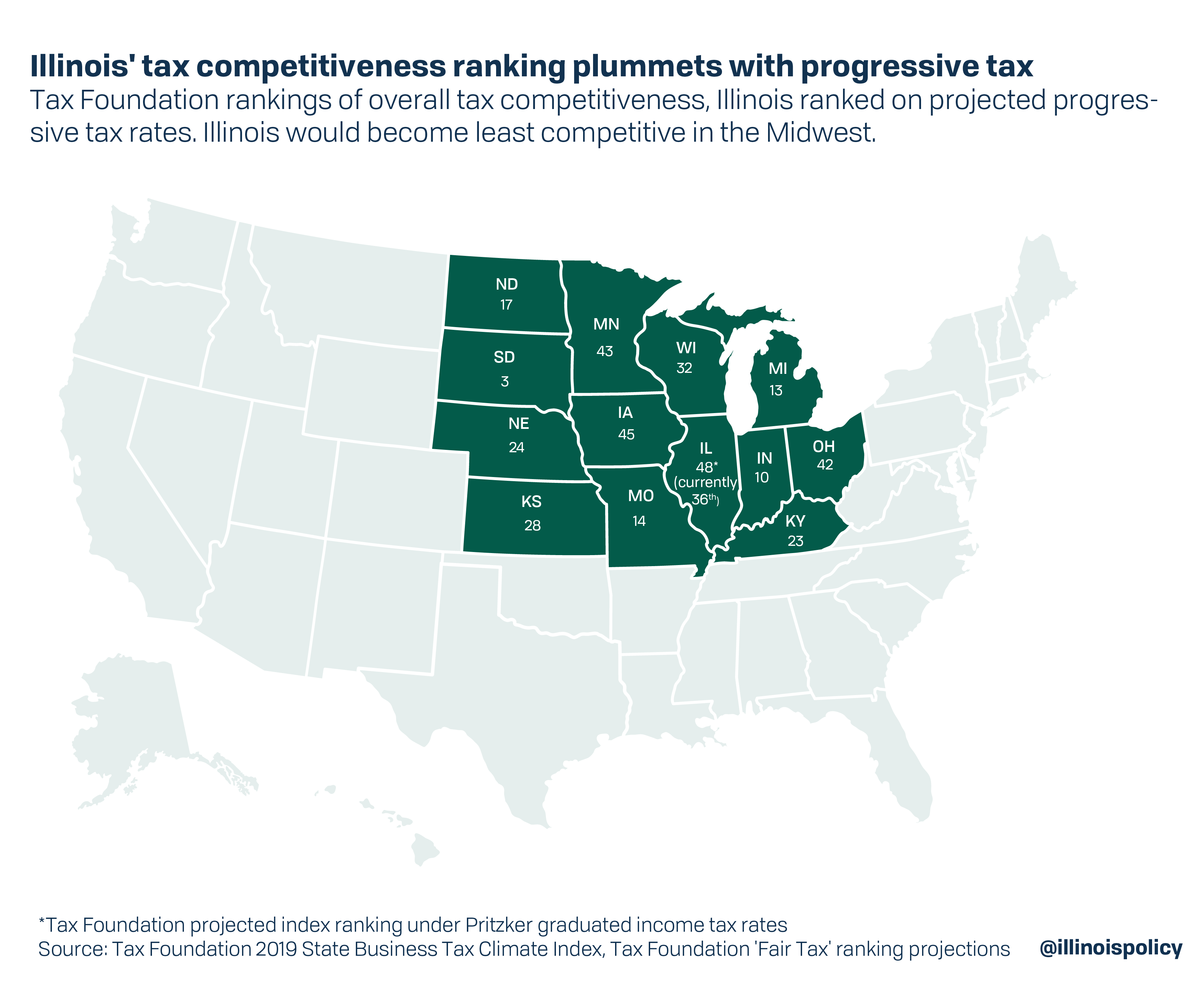

Pritzker Fair Tax Would Drop Illinois Business Climate To 48th In Nation

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

Illinois Tax Credit To Relieve Minimum Wage Increase Dhjj

Illinois Child Support Calculator Il Free Online Tool

How Much Would You Pay In Illinois Income Tax Under Pritzker Plan Across Illinois Il Patch

Illinois Tax On Moving And Relocation Services Avalara

How To Calculate Cannabis Taxes At Your Dispensary

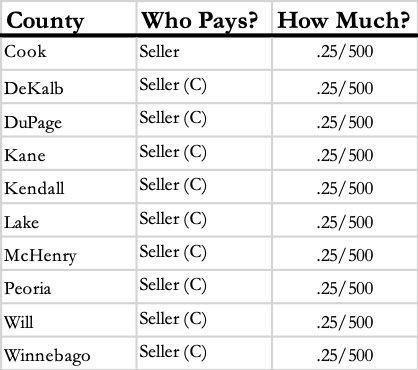

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Paycheck Calculator Smartasset

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate